|

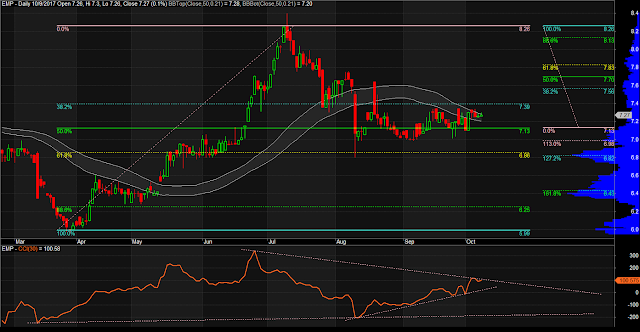

| $X Daily Chart as of October 23, 2017 |

Notes:

1. Price appears to be holding around the 113% Fib Ret level.

2. RSI is far from breaking that trend line resistance. Moreover, RSI direction is not the 50 level.

3. Bolinger Band is contracting, observe which direction price would eventually head.