|

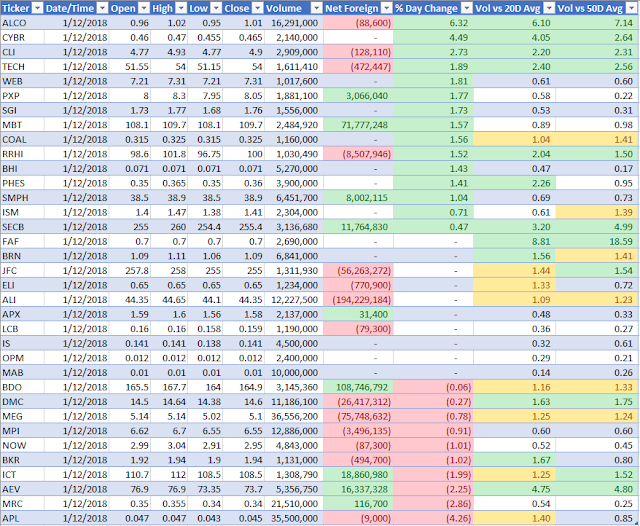

| Study List (January 12, 2018) |

Notes: stocks listed here have increasing volume in the past three trading days.

|

| Watch List (End-of-Day, 12 January 2018) |

|

| Top Weekly Gainers / Losers (January 5, 2018) |

|

| $MPI Weekly Chart as of December 29, 2017 |

|

| $APX Weekly Chart as of December 29, 2017 |

|

| $EMP Weekly Chart as of December 29, 2017 |

|

| $RWM Weekly Chart as of December 29, 2017 |

|

| $AGI Weekly Chart as of December 29, 2017 |

|

| $SGI Daily Chart as of December 29, 2017 |

|

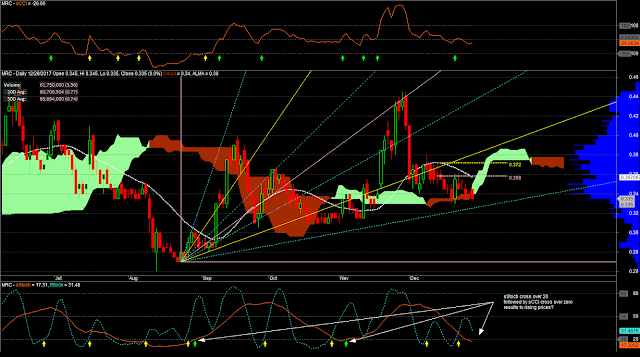

| $MRC Daily Chart as of December 29, 2017 |

|

| $PXP Daily Chart as of December 29, 2017 |

|

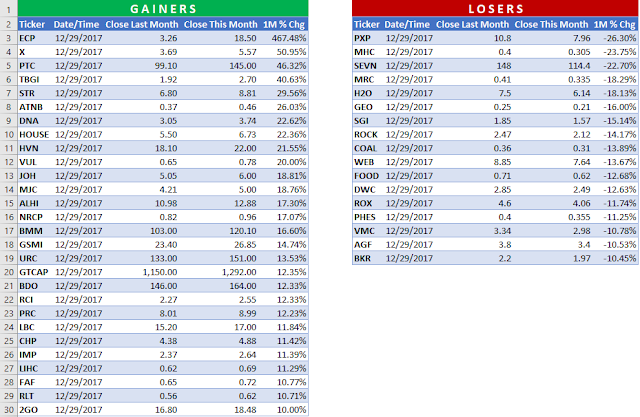

| Top Monthly Gainers / Losers of December 2017 |