|

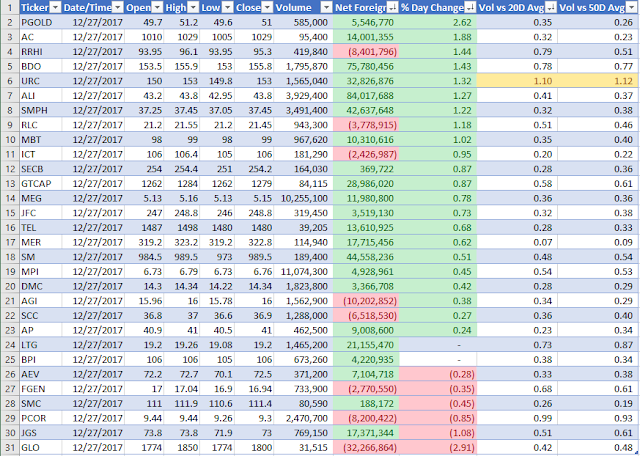

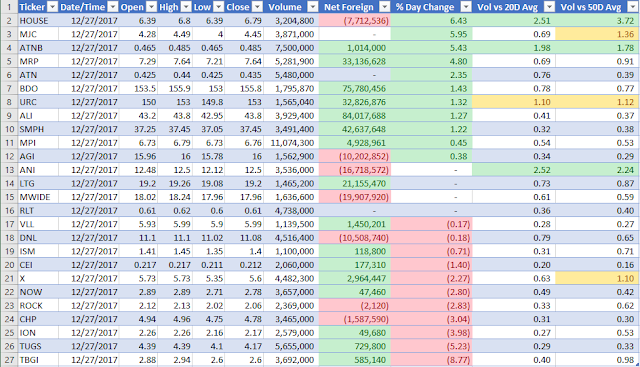

| Watch List (End-of-Day, 27 Dec 2017) |

Notes: the general idea here is that a stock whose Stochastic is below 20 is considered at oversold level (and we only consider a second look at the stock when Stochastic crossed over 20).

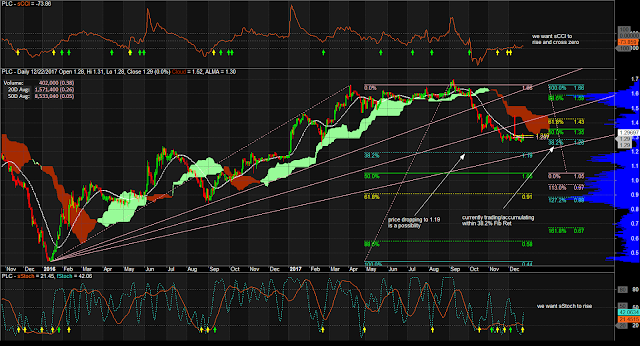

1. New to the list are $ISM, $PHES, $CYBR, $SGI, $MA, $PIP, $ROCK, $ION, $TBGI, $IDC, $PLC, and $MRC.

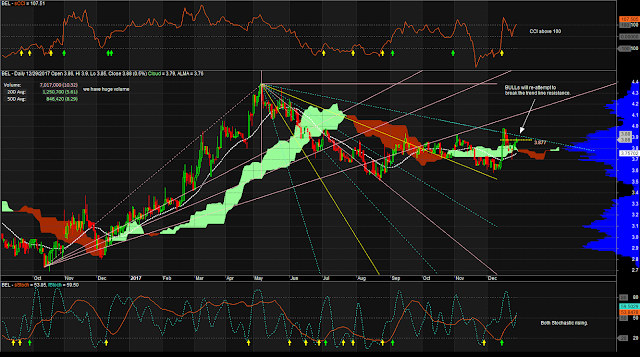

2. Removed from previous listing are $MJC, $FGEN, $DNL, $RLC, $CPM, $BHI, and $PXP. Any stock _not_ listed here is because either of their low volume or of their above 22 Stochastic.

Vol vs 20D Avg is the ratio of today's volume against the 20-day vx`olume average. Vol vs 50D Avg is the ratio of today's volume against the 50-day volume average.A value greater than 1 means today's volume is higher than the average (while a value less than 1 means today's volume is lower than the average). A green highlight means today's volume is 50% or more than the average (while a yellow highlight means today's volume is greater than the average but less than 50% more of the average).Listing Criteria:1. Volume today must be more than 1M.2. Stochastic is below 22.Mind the levels. Manage the risks. Protect your capital. Protect your gains.DISCLAIMER: This is my unsolicited Point of View and is _not_ a recommendation to buy/sell the security.*** DO NOT *** attempt to trade unless you FULLY understand the associated (financial/emotional) risks and you FULLY accept responsibility of the results of your actions.