|

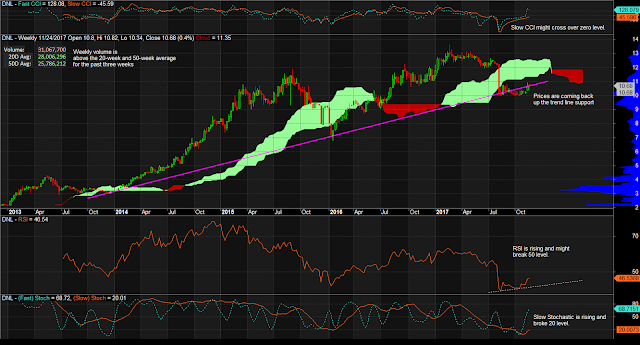

| $PXP Weekly Chart as of November 24, 2017 |

Notes:

1. Volume is a big check. With such number of participants, you can trade in and out of this stock.

2. We want price to not slide past 9.89 from here on. At best, price should break the 13.56 level.

3. CCIs are well above zero level and are pointing up. Adds confidence on momentum-wise.

4. RSI is ranging around 70 level. May it be kept that way or better move to higher levels.

5. We want Slow Stochastic to remain above 80. Should it fail, then we can consider standing on the sidelines. We want that Fast Stochastic to turn up (entry/re-entry opportunity) and rise to higher levels.

6. Warning: this is a weekly chart and such requires a week long market activity to feel the sentiment of the market.

Mind the levels. Manage the risks. Protect your capital. Protect your gains.

DISCLAIMER: This is my unsolicited

Point

of

View and is _not_ a recommendation to buy/sell the security.

*** DO NOT *** attempt to trade unless you FULLY understand the associated (financial/emotional) risks and you FULLY accept responsibility of the results of your actions.