|

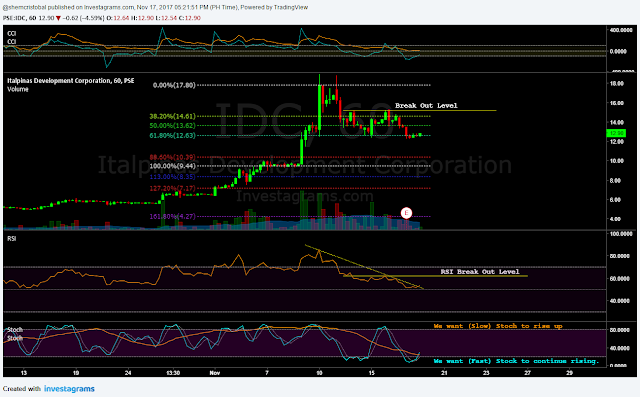

| $IDC Hourly Chart as of November 17, 2017 |

Notes:

1. Trading at 61.8% Fib Ret level. must hold this as support and break out of that level.

2. CCI must move towards and stay above zero level.

3. RSI broke that trend line resistance. Must continue rising and break out of that level.

4. (Fast) Stochastic crossed over 20 level and rising. We want (Slow) Stochastic doing the same.

Mind the levels, manage the risks.

No comments:

Post a Comment